How to Get a Lower APR on Credit Cards in 2025?

- 22 Oct 25

- 6 mins

How to Get a Lower APR on Credit Cards in 2025?

Key Takeaways

- The average credit card APR in India often ranges between 24% and 48%, so knowing how to get lower APR on credit card can save you serious money.

- Improving your credit score (on-time payments, lower utilization, fewer hard inquiries) is the most reliable lever to lower APR.

- Consider pre-approved cards; they reduce the risk of rejection and can come with better APR terms.

- Balance transfers can temporarily cut costs via introductory APRs—just watch the transfer fee and promo expiry.

- To avoid interest entirely, pay in full by the due date; paying at least the minimum reduces (but doesn’t eliminate) interest and debt buildup.

The average credit card APR in India can range from 24% to 48%, which applies when you miss your payment due date. This leads to higher costs beyond your original purchases, as the interest accumulates on your balance. However, you don’t need to worry! We will walk you through a guide on how to get lower APR on credit cards.

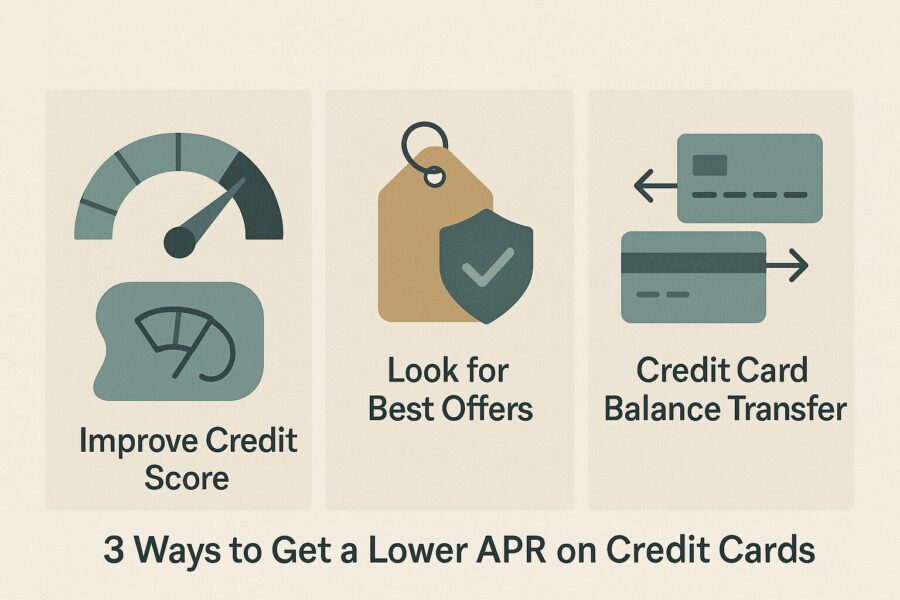

3 Ways to Get a Lower APR on Credit Cards

The credit card bill amount attracts a monthly interest rate on the outstanding amount beyond the due date. However, the interest accrued per year is termed Annual Percentage Rate (APR). Here's how to get lower APR on your credit cards:

1. Improve Your Credit Score

If you have a good credit score, your credit card might attract a lower APR. In case you have a low credit score, you can improve it by making timely payments within the due date. Setting up automatic payments can help you pay your credit card bills on the due date.

Further, spending a lower amount than your credit limit can help you improve your credit score. Applying for multiple credit cards within a short span can affect your credit score adversely. Ensure you apply for credit cards only when you need them.

You can additionally check your credit report to find out your credit score. If you have a good credit score, ensure you maintain it with the best practices mentioned above.

2. Look for the Best Credit Card Offers

Applying for a credit card with a low credit score affects your credit history and credit report. As an alternative, you can look for pre-approved credit cards that banks issue based on your existing credit score.

Pre-approved credit cards indicate that you are eligible for the offer. As a result, you can avoid application rejections, which further adversely impact your credit report. This can help you get a lower APR.

3. Look for Credit Card Balance Transfer Options

A credit card company might offer balance transfer cards. Certain credit card issuers offer a temporary low APR offer on balance transfer in addition to purchase APR. You can look for a balance transfer offer to get a lower introductory APR from the new issuer.

Notably, you need to check the balance transfer fees for a seamless experience. Moreover, the temporary low APR offer might expire after a specific tenure. A standard APR rate might apply thereafter.

💡Pay your credit card bills in an easy and secured way and experience smooth transactions with the PICE App.

Ways to Avoid Credit Card Interest Charges

- You need to pay the entire credit card monthly bill amount by the payment due date to avoid attracting additional interest charges.

- If you pay the minimum amount due (minimum payment required for a billing cycle), you will attract lower interest charges on the outstanding amount.

- You can pay smaller amounts (interest-free payments) multiple times throughout the billing cycle or grace period till the bill due date to avoid interest charges.

- If you pay more than the minimum amount, you can reduce the outstanding balance and the interest on the outstanding balance.

Notably, you need to be aware of credit card scams that promise to reduce your interest rate, offer cash back and other facilities. These authorities often charge high fees for interest rate reduction, there might be a penalty APR criteria, or they are fraudulent organisations. Ensure you associate with reliable organisations for APR reduction.

Why Should You Try to Lower APR on Credit Cards?

A lower APR on credit cards helps you save money that you pay on interest (interest savings). In addition, it helps you become debt-free faster as you do not have to pay high APR for debt settlement. Consider the following example to understand the scenario:

Suppose Mr X has ₹10,000 outstanding on his credit card beyond the due date of 25th August 2025. Let us assume it will attract an interest of 35% annually. Thus, the total amount that Mr X will have to pay is ₹10,000 + (35% * ₹10,000) = ₹13,500.

If Mr X paid the entire amount, which is ₹10,000, by 25th August 2025, he could have avoided the additional interest of ₹3,500. This would have helped him save more.

On the flip side, if Mr X plans to pay off ₹13,500 in 3 months in equal instalments, he would have to pay ₹4,500 each month till 25th November 2025. However, if he paid ₹10,000 by 25th August 2025, he would not have the burden of debt for the next 3 months.

You can additionally lower your APR by paying the minimum amount or more than the minimum amount. Let us consider the same example above to understand.

Suppose Mr X pays ₹2,000 (minimum amount) on 25th August 2025 out of the credit card bill amount of ₹10,000. Then he will attract an interest of 35% on the remaining ₹8,000. Thus, the total amount that Mr X will have to pay is ₹8,000 + (35% * ₹8,000) = 10,800.

As a result, by paying the minimum amount of ₹2,000, Mr X can save ₹13,500 - ₹10,800 = ₹2,700.

Conclusion

Now that you know how to get lower APR on credit cards, ensure you implement the best practices. This can help you save more and avoid unnecessary interest payments. You need to pay your bills within the due date to avoid attracting additional interest charges. Further, you can pay the minimum amount due to lower your interest amount. Ensure you use your credit card strategically to maintain good credit scores.